Quite a few kinds of investment accounts give tax-deferred benefits to holders, Each individual with their own personal benefits and eligibility requirements. Here are some examples: Types of tax-deferred investment accounts Standard IRAs

Asking yourself the place to start (or conclusion) with AI stocks? These ten uncomplicated shares can assist investors Establish prolonged-expression wealth as synthetic intelligence proceeds to mature into the longer term.

close Essential Data Digital Assistant is Fidelity’s automated organic language online search engine that will help you locate info on the Fidelity.com web page. As with any internet search engine, we talk to that you not input private or account information. Details which you enter is not really stored or reviewed for almost any purpose other than to provide search engine results.

× The gives that appear In this particular table are from partnerships from which Investopedia receives compensation. This payment could influence how and wherever listings seem. Investopedia isn't going to consist of all presents accessible in the marketplace.

Being a rule of thumb, quite a few money advisers express that a tax-deferred IRA is usually a better option for those who anticipate their cash flow (as well as their taxes) for being reduce when they retire. A Roth can be a better choice for people who expect to generally be inside of a superior tax bracket soon after retiring.

Wealth protection involves shielding one particular’s gathered wealth from unforeseen occasions for instance accidents, health issues and home harm, and third events including creditors, litigators, and overzealous tax authorities.

Will probably be eradicated totally Should your income then reaches the next sum. These deductible amounts also will change based upon your submitting position. IRS Publication 590-A can offer you with the small print.

By purchasing a inventory fund, you’ll get the weighted typical return of all the businesses in the fund, And so the fund will normally be fewer volatile than if you experienced held just some shares.

Tax-exempt accounts present upcoming tax benefits as opposed to tax breaks on contributions. Withdrawals at retirement will not be subject to taxes, matter to selected needs—for your Roth account, by way of example, it's providing you've experienced the account for at least five years.

Take into consideration prioritizing shorter-expression bonds. These bonds mature in less than 5 years are considerably less sensitive to fascination charge hikes than long-phrase bonds, whose prices often tumble far more sharply as inflation rises. As mentioned above, Strategies may also supply a layer of protection to the portfolio.

These types of entities — like asset protection trusts, irrevocable trusts, and restricted liability entities or organizations for business-associated functions –– may help protect particular wealth during the celebration of lawful troubles or business disputes.

Overview: A inventory fund has a group of shares, often unified by a particular concept or categorization, such as American stocks or useful source significant shares. The fund company costs a charge for this item, but it surely can be very very low.

Tax-Exempt Accounts A lot of people disregard tax-exempt accounts simply because their tax benefits can happen so far as forty decades into the longer term. Nevertheless, youthful Grown ups that are both in class or are merely setting up perform are ideal candidates for tax-exempt accounts Retirement portfolio diversification like Roth IRAs.

To stay aligned with your economical objectives and danger tolerance, you'll want to critique your portfolio and alter asset allocations periodically. For instance, if inflation persists, it's possible you'll take into account escalating exposure to dividend shares or REITs.

Jenna Von Oy Then & Now!

Jenna Von Oy Then & Now! Jennifer Love Hewitt Then & Now!

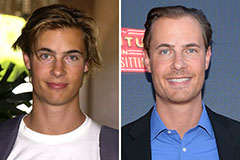

Jennifer Love Hewitt Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Bo Derek Then & Now!

Bo Derek Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now!